NERA Economic Consulting has released a new study on consumer class action settlements that indicates the number of such cases is steadily growing. The data also indicates that New Jersey is one of the most popular jurisdictions for filing consumer class actions.

In Consumer Class Action Settlements: 2010 – 2013, NERA analyzes settlements in consumer class actions using a database of 479 such cases created by them from public data sources such as newspaper articles. Cases included in the database are all consumer based, and include issues such as consumer fraud, antitrust-related claims such as price fixing, false advertising, and product liability claims.

As NERA’s executive summary explains:

NERA identified 479 consumer class actions with either a preliminary or final settlement reached over the course of the 2010 to 2013 period. Of these, 321 cases had a reported settlement fund value. In 2013, NERA found 161 consumer class action settlements compared to 141 in 2012 and 66 in 2010.

Of the 321 cases with a reported settlement value, 84 percent included a monetary payment to plaintiffs as at least one component of the settlement. Only 26 percent of cases included a non-monetary payment, and only 6 percent included a donation to charity as a major component of the settlement.

Aggregate settlement values varied from year to year, ranging from $1.7 billion in 2010 to $9.7 billion in 2012. The average settlement value for consumer class actions during the four year period was $56.5 million. This figure was impacted by several large settlements including a $7.25 billion Visa/MasterCard settlement in 2012 and a $1.6 billion Toyota settlement in 2013. The median settlement for the 2010 to 2013 period was $9 million.

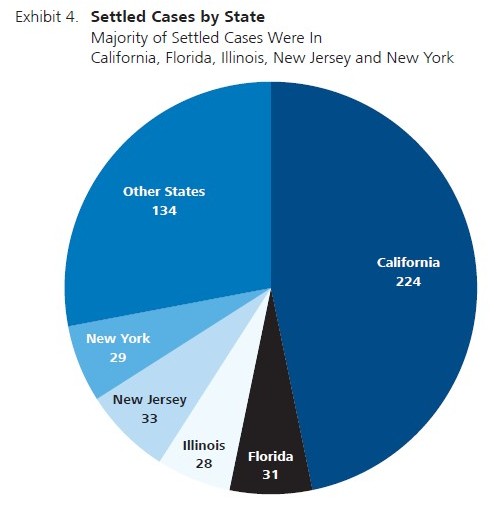

One of the other data points NERA breaks out is where cases are located. Nearly three-quarters of consumer class actions, 345 of 479, were settled in five states: California, Florida, Illinois, New Jersey, and New York.

NJCJI is not surprised that New Jersey made the list of most litigious consumer class action states given our overly broad consumer fraud act, weak rules on expert evidence, unlimited appeal bonds, and the inability of litigants to appeal class certification decisions prior to final judgment.

If you are interested in learning more about consumer class actions, we encourage you to read NERA’s full article, and to register for NJCJI’s upcoming events on the topics.

Leave A Comment